Bitcoin SV: The Miner-Friendly Blockchain

The Bitcoin community’s three-way split brought about by disagreements on the issues of scaling and changes in protocol confused not only investors, but also miners, as to which is the best one to spend their time and money in.

Following the two forks in 2017 and 2018, the market now has Bitcoin Core (BTC), Bitcoin Cash (BCH) and Bitcoin SV (BSV). This article argues that Bitcoin SV is the miner-friendly blockchain and the soundest investment of the three.

Bitcoin Mining

Being a miner involves considerable investment in a facility that involves hi-tech hardware, software and cooling system, not to mention overhead costs for electricity and salaries for capable engineers and technicians. This is all so miners can complete transactions and win the right to add a new block onto the blockchain which earns them a block reward diminishing subsidy. This process involves a huge amount of computing power to solve highly complicated mathematical equations so every penny earned is vital to the long term health of the miner.

https://www.youtube.com/watch?v=XyO7767UvuQ&feature=emb_title

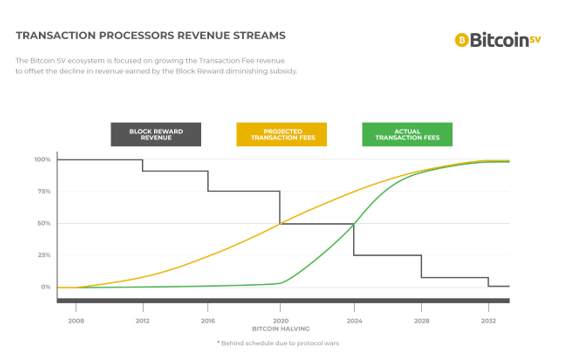

Miners earn in two ways, through block reward fees and transaction fees. There were only 21 million Bitcoin’s issued when the network went live and this is the total supply that will ever exist. The protocol issues the tokens to the miners to get them into circulation, eventually all of the tokens will be in circulation. The block rewards are halved every four years, with the latest halving inMay 2020 being at 6.25 Bitcoin. In this sense, it is clear that the protocol designed by Satoshi was such that the miners, over time, need to earn more fees from transactions instead of relying on the diminishing block reward subsidy as the main way to earn revenue because it disappears. And this is why scaling to increase block sizes are essential to miners’ and Bitcoin’s survival, the network needs a massive amount of transactions to be economically viable for miners to maintain and enforce the protocol rules.

Mining BTC and BCH

At present, BTC has its block size cap at 1MB, processing only a maximum of seven transactions per second, while BCH has it at 32MB, which can accommodate up to 60 transactions per second. Because BTC and BCH did not want to scale any further, revenues in transaction fees have remained very small over the years.

Image source: BitcoinSV.com

This is why BTC and BCH miners are called “block reward miners,” because the bulk of what they earn come from the block reward diminishing subsidy, which is expected to become even smaller in the next halving in 2024. It is obvious just from these basic numbers that mining BTC and BCH is a pathway to unprofitability.

Bitcoin SV Mining

What makes Bitcoin SV totally different from the two is that the network has made massive scaling a priority. Not even a year had passed after the split from BCH, and Bitcoin SV already increased its block size cap from 128MB to 2GB. In February 2020, Bitcoin SV released the Genesis Upgrade that uncapped its block size and brought back the original Bitcoin Protocol that is now set in stone.

https://www.youtube.com/watch?v=1qzTi6PiM8E&feature=emb_title

Today, Bitcoin SV can process thousands of transactions per second and is expected to reach 50,000in 2021. This makes low-cost microtransactions possible, pushing transaction volumes up and continuing to increase revenues to miners from a wider range of customers (transaction generators). The commitment to a stable protocol and massive scaling is what makes Bitcoin SV the miner- and enterprise-friendly blockchain.

Nice Article!